Nordic Banking Insights Q3 2025: The New Normal Takes Hold

Review of the first nine months and outlook for 2026

After three exceptional years, Nordic banks face a steeper climb as the “new normal” takes hold.

The large Nordic banks delivered solid Q3 2025 results, posting an average return on equity (ROE) of 14.6% — roughly two percentage points below the 2023–2024 peak, yet still well above pre-2022 levels. This remains a strong aggregate performance, especially considering the banks’ high capitalisation (see Chart 1).

However, the outlook is turning more challenging. Both revenue and cost pressures are building, creating a tougher backdrop as the sector heads into 2026.

Chart 1: Key financial figures for Q3 2025. Cost-to-income (C/I) ratio incl. regulatory levies. Sources: banks’ interim reports and factbooks. FX rates per 30 September 2025. ECB reference rates.

The New Normal Sets In

The main driver of the Nordic banking profit boom in recent years has been higher interest rates and the resulting surge in net interest income (NII). That tailwind is now fading: central bank policy rates have fallen markedly over the past year and appear to be settling near their current levels for the foreseeable future (see Chart 2).

Chart 2: Nordic central bank policy rates 2016–2027 (%). The ECB’s policy rate is shown for Finland. Forecasts based on Nordea, SEB and DNB economic outlooks.

This shift is a double-edged sword. The good news is that while rates have dropped from their peaks, they remain well above the near-zero levels of the years preceding the 2022 hiking cycle. As a result, banks’ NII will likely stabilise at a structurally higher level than before — supporting profitability in 2026 and beyond (see Chart 3).

The downside, however, is the immediate revenue drag. Because asset and liability repricing occurs with a lag, the full impact of lower rates has not yet been felt. The coming quarters will reveal where the new equilibrium for NII truly lies.

Chart 3: Nordic banks’ quarterly NII development, Q3 2020 – Q3 2025, rebased = 100

To gauge how exposed the banks are to declining rates, it is useful to review how their revenues have evolved over the past five years. As Chart 4 shows, most of the growth since 2020 has been driven almost entirely by NII, with limited progress in diversifying toward fee- or trading-based income.

Chart 4: Contribution of NII and other income to banks’ total revenue growth, 2020–2024 (%). Sources: banks’ annual reports.

In 2020–2024 Danske Bank relied almost exclusively on NII for revenue growth, with Nordea and DNB not far behind. DNB, however, has meaningfully reshaped its revenue mix in 2025 through the Carnegie acquisition [1], which, in the past two quarters, has increased the share of non-NII income to nearly 30% of total growth compared with 2020.

SEB stands out as the only bank that has consistently strengthened its fee-based income, generating roughly one-third of total revenue growth from non-NII sources.

In short, while all the major Nordic banks — except Danske — have improved their fee income to some extent, only SEB and DNB have done so at scale. The others remain highly sensitive to future changes in central bank policy rates.

It Will Be a Cost Game In 2026

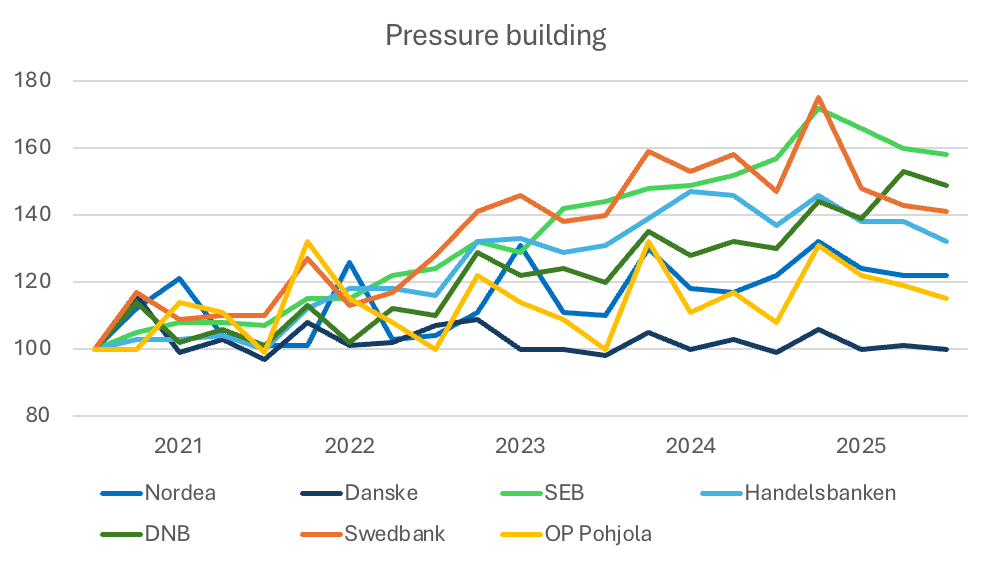

With top-line pressure intensifying, the cost side of the P&L is becoming the key battleground. Most banks have seen expenses rise in recent years (see Chart 5), driven by wage inflation, additional regulatory levies, as well as forward-looking investments funded by the NII-fuelled profit surge.

Chart 5: Banks’ quarterly expenses, incl. regulatory levies, Q3 2020 – Q3 2025, rebased = 100.

In this review, Danske stands out as the most disciplined bank in the group with flat costs during the last five years allowing it to focus on its top-line growth and worry less about cost. Nordea and OP Pohjola have similarly kept a relatively strong cost control over the time period while the rest of the banks are potentially facing some serious cost problems in 2026.

Many have already reacted to this with Handelsbanken focusing on cutting its headcount since early 2024, and Swedbank and SEB imposing external hiring freezes (Swedbank recently lifted its hiring ban, though). These actions are starting to bear fruit, though more remains to be done.

While DNB’s expenses have risen quite significantly since 2020, they are not in a similar position as the rest of the group due to two main reasons: First, they continue to benefit from the strong Norwegian economy and the much higher central bank policy rate, than rest of the Nordics, and second, they have taken deliberate action to diversify their revenue mix with the acquisition of Carnegie providing a significant boost to their asset management and investment banking income. Hence, they will face much less pressure to cut cost in 2026 than their peers.

Beyond wage inflation and regulatory levies, much of the recent cost growth also reflects the banks’ forward-looking investments — at least as they frame it. Nordea has channelled spending into technology and risk management, OP Pohjola and SEB into cloud migration and artificial intelligence, and others into digital customer platforms. So far, these initiatives have yet to show a clear positive impact on the P&L. But if the promised efficiencies and new revenue streams begin to materialise in 2026, they could put these banks on a stronger competitive footing just as the rate tailwind fades.

Leaders and Laggards

Heading into 2026, Nordea, DNB, and Swedbank continue to lead the way with the region’s highest profitability and solid foundations for the coming year.

Nordea’s scale and diversified business model make it resilient to market fluctuations.

DNB benefits from a robust Norwegian economy and decisive strategic moves.

Swedbank, supported by an efficient operating model and a sizeable capital surplus, may soon have the flexibility to pursue additional strategic investments.

At the other end of the spectrum, Handelsbanken’s position looks challenging. The bank has been deliberately shrinking its footprint in recent years [2], faces mounting cost pressure, and is now generating roughly the same level of income as OP Pohjola, despite being twice its size.

Still, none of the major Nordic banks are in poor shape. All are expected to post double-digit ROE in 2026. The issue is one of expectations: several have set long-term ROE targets around 15%, and after three years of exceeding those levels (see Chart 6), shareholders are unlikely to accept a downward revision of ambition.

Chart 6: Banks’ quarterly ROE, Q3 2020 – Q3 2025 (%).

One area to watch in 2026 will be M&A activity. Several Nordic banks hold significant excess capital, with some soon gaining more flexibility to deploy it. Danske Bank (€3 bn above target), OP Pohjola (€2 bn), and Swedbank (€1.5 bn) all have the balance-sheet strength to act if attractive opportunities emerge.

Danske appears particularly well-positioned to make a move: following the divestment of its Norwegian personal banking operations [3] and a clear shift toward growth, the bank seems ready to re-enter the strategic acquisition arena — a notable change in tone after nearly a decade of compliance-driven retrenchment.

Bottom Line: 2026 Will Be Good – but Not Necessarily Good Enough

To summarise:

Net interest income will normalise in 2026 — lower than the 2023–2025 boom years, yet still far above pre-2022 levels.

Costs are set to become the key differentiator, with several banks already tightening spending.

Profitability will remain healthy but taper off, leaving management teams under pressure to sustain shareholder returns amid slower growth and rising efficiency demands.

The Nordic banking sector remains fundamentally strong — well capitalised, profitable, and disciplined — but the easy gains are now behind it. The next phase will test execution: who can defend margins, control costs, and find new revenue engines in a “higher for longer, but not forever” rate environment.

References

[1] https://www.ir.dnb.no/press-and-reports/press-releases/dnb-bank-asa-acquires-carnegie-accelerates-nordic-strategy-and

[2] https://mb.cision.com/Main/3555/3436107/1483153.pdf

[3] https://www.nordea.com/en/press/2023-07-19/nordea-to-acquire-danske-banks-personal-customer-business-and-associated-savings-assets-in-norway