Nordea’s 2030 Strategy

What we learned from Nordea’s 2025 Capital Markets Day

Nordea kept its core financial target unchanged: a return on equity (ROE) above 15% for 2026–2030, and significantly above in 2030. This outcome was largely expected. Having consistently delivered ROE above 15% since 2023, Nordea had limited strategic room to either lower the target (which would have raised questions about momentum) or raise it (which would have been unrealistic in the current operating environment). The bank is, in a sense, “trapped by its own success.”

But this does not make the target easy. As I’ve noted in earlier analyses, revenue and cost headwinds facing Nordic banks are real. Sustaining >15% ROE will require meaningful improvements in productivity, operational efficiency, and capital deployment — particularly as rates normalise.

In this article, I break down the key strategic actions Nordea is signalling for the next strategy period, and assess whether they are sufficient to defend — and potentially strengthen — the bank’s competitive position through 2030.

Nordea HQ in Copenhagen

Growth

A welcome element of Nordea’s new strategy is its clear growth ambition. The bank targets faster-than-market expansion, translating to 4–5% annual growth versus an estimated 3% market average. Achieving this would lift Nordea’s already high market shares by a relative 5–10%, equivalent to about 1–3 percentage points (author’s estimate) of absolute market-share gains over the next five years — a meaningful improvement for a mature Nordic bank.

After several years of prioritising cost discipline, core technology renewal, and risk management, this renewed commercial focus will be well received by Nordea’s business-area leaders. That said, it is not entirely new. Nordea has previously aimed to outgrow the market — most notably in Sweden — but results have been mixed. In Swedish mortgages, for instance, Nordea’s market share has been broadly flat for more than a decade, even slightly declining [1]. To alter this trajectory, something more fundamental must change in Nordea’s customer-acquisition and product-differentiation approach.

Harmonised Processes and Shared Tech Platforms

Importantly, Nordea made clear that it does not intend to compete on price. Instead, it will lean on its digital advantage and Nordic scale benefits — harmonised processes, shared platforms, and cross-market delivery models — starting with four end-to-end value streams: mortgages, corporate lending, savings & investments, and payments.

The strength of this approach is that it starts from the process, at least in lending. That is a more robust way to establish truly end-to-end value streams than a technology-first push — something Nordea has tried before. Ultimately, those Nordic processes will need a simplified tech stack and shared platforms, but a process-driven approach keeps the business and customer lens in the driver’s seat, with technology enabling (not dictating) change.

Mortgages Will Be the Ultimate Test

Among the focus areas, harmonising the mortgage journey across four countries looks the hardest. Local practices differ markedly — Denmark’s match-funded mortgage system being globally distinctive — which will limit the degree of harmonisation. While targeting ~90% automation of loan promises for non-complex cases makes sense for cost and speed, the post-promise steps (advice, negotiation on margin, documentation) will likely continue to require human capacity. Unless Nordea can deploy sufficiently empowered AI-assisted advisory to handle more of these later-stage interactions (including pricing guardrails), efficiency gains may be bounded by customer expectations for high-touch service in the largest transaction of a household’s life.

In savings and payments, Nordea plans technology-driven process improvements and the installation of shared platforms. That pathway looks more feasible: retail savings is increasingly commoditised, and in payments — especially corporate cash management — speed and simplicity often trump bespoke customisation. In wealth management, Nordea will target mass-affluent customers with a renewed digital offering and invest in high-touch Private Banking by hiring ~100 new advisers (about a 20% increase from a ~500 base). This barbell is exactly right — and consistent with future market trend predictions — digital at scale for the affluent, and human-led advice at the top end [2].

AI-Driven Personalisation

A unifying theme across all Nordea’s business areas is the increased use of artificial intelligence to enhance customer interaction and advisory productivity. The bank aims to combine human expertise with AI-driven insights, enabling advisers to deliver more personalised, timely, and relevant advice — while spending less time on manual preparation and data retrieval.

This ambition represents the long-standing “holy grail” of banking: the seamless utilisation of the vast data already held within the organisation. Banks collect extensive customer information through KYC, credit processes, payments, cards, and digital channels, yet this data typically resides in siloed systems that are difficult to integrate due to differing architectures and data models. Nordea’s new strategy signals a determined push to overcome this, creating a single data backbone that supports both customer engagement and operational decision-making.

In essence, Nordea is embarking on a group-wide data harmonisation and lineage programme, extending principles long required for regulatory risk data (under BCBS 239) into the commercial domain. Few banks have succeeded fully in this effort; if Nordea can, it would create one of the most valuable competitive advantages in Nordic banking — a genuinely data-driven institution where AI supports every adviser, process, and customer interaction.

Efficiency

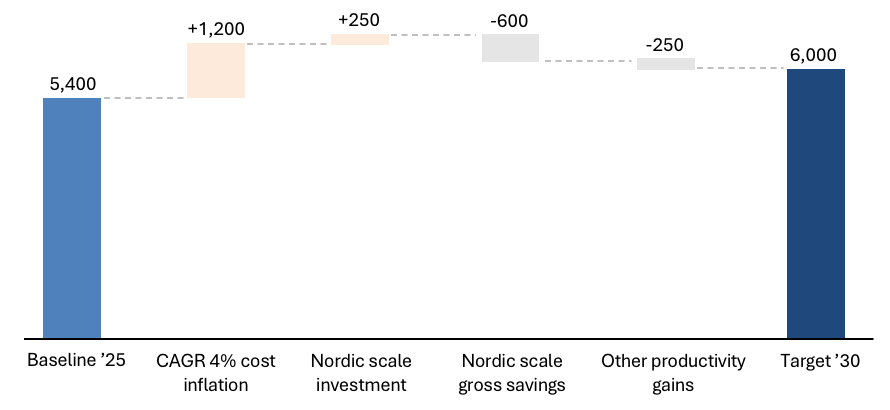

Alongside growth, Nordea is committing to significant cost savings. While underlying cost inflation is expected to average ~4% per year through 2030, Nordea commits to limit cost growth to 2% — implying roughly €600m in efficiencies from a €5.4bn cost base by 2030. The savings will come from technology integration, automation, and process harmonisation — but with personnel costs at ~60% of total expenses, FTE reductions will inevitably play a significant role.

The biggest lever is the Nordic scale programme targeting €600m gross annual cost take-out by 2030, offset by ~€250m of investments, for ~€350m net. The balance will need to come from broader productivity gains to bridge the full cost-growth gap to 2%.

See Chart 1 for simplified illustration of the cost path.

Chart 1: Estimated Nordea cost path, 2025–2030 (EURm).

The Price to Pay

Assuming that at least 60% of all savings come from staff reductions — in line with personnel’s current share of the total cost base — and an average annual personnel cost of €100,000, the efficiency drive could mean a reduction of ~3,600 FTEs, or >10% of Nordea’s current workforce.

It could also be more. A large part of the narrative hinges on system decommissioning. This has been a difficult promise across the industry (including Nordea’s earlier Simplification initiative and, among peers, SEB’s cloud push), and new security/resilience requirements tend to raise baseline tech spend even as platforms modernise. If decommissioning under-delivers, staff costs may have to carry a larger share of the savings — pushing total reductions toward ~6,000 FTEs by 2030 in a downside execution scenario. (This is my analytical scenario, not management guidance.)

Bottom Line

If successful, Nordea’s dual agenda — faster growth and deeper efficiency — could sustain its >15% ROE into the next strategy period. But history shows that doing both at once in mature Nordic markets is exceptionally hard. The credibility of the 2030 strategy will depend less on targets and more on visible productivity gains delivered without eroding customer momentum.

The current leadership team brings an impressive track record — five consecutive years of above-target performance and consistent delivery since 2019. Yet the next phase may be its most demanding. The ambition — a truly Nordic operating model that fully leverages scale and scope — is not new.

What’s different now is the method: a modular execution approach rather than another mega-programme. That reduces programme risk and accelerates learning cycles. The test is integration: all the discrete projects must converge into one coherent model — the One Nordea the bank has pursued for nearly 25 years. That will require not only scale and technology, but also unity of leadership, culture and execution discipline across all four home markets.

Nordea has rebuilt competitiveness over the past six years and is now attacking the market from a position of strength. It is also going all-in on Nordic scale — redesigning key value streams, modernising platforms, and applying AI at scale to personalise service and automate operations where sensible. It’s an ambitious strategy, and prior attempts have not fully landed — but each has moved Nordea closer. Given the leadership’s delivery record, this is the right call — and exactly what one would expect from the Nordic champion.

References

[1] https://www.financesweden.se/media/0jdf50jq/the-mortgage-market-in-sweden_sept-2025.pdf

[2] https://thoughtlabgroup.com/future-ready-investment-firm/