SEB Q3 2025: Not Quite There

SEB reported its Q3 2025 earnings today, delivering a return on equity (ROE) of 14%.

While solid in absolute terms, this is below the Nordic peer group average—a position SEB is not accustomed to. It also falls short of their long-term aspiration of 15%. All in all, a respectable but underwhelming quarter by SEB’s own standards.

This is not yet a cause for alarm. The delta remains modest, and it’s only been a few quarters where SEB has found itself on the wrong side of the peer average. But the trend is noticeable.

SEB’s quarterly ROE, their ROE target/aspiration and the Nordic peer bank average ROE (%). Nordic peers include Nordea, Danske, DNB, Handelsbanken and Swedbank. Q3/2025 figure excluding Danske (has not reported yet). Source: Sample banks’ interim reports and factbooks.

The Cost Challenge

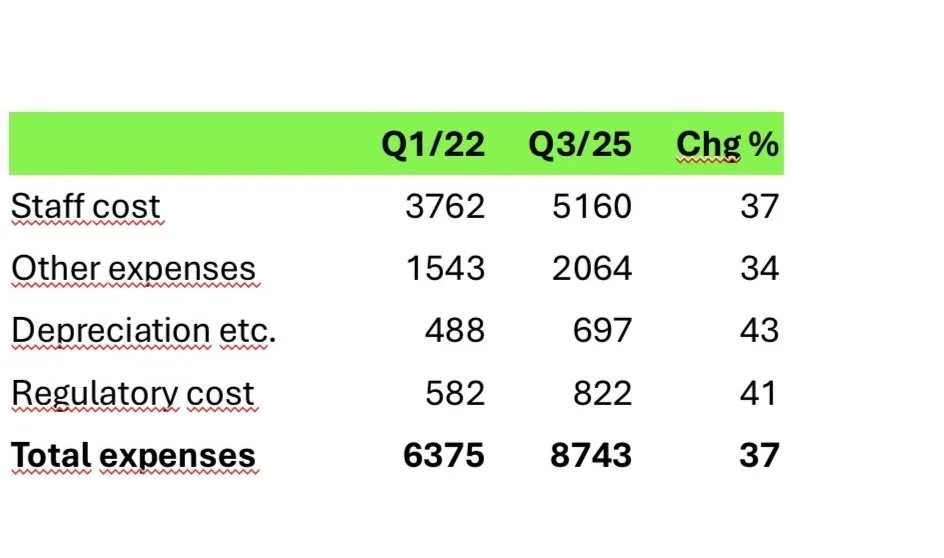

The main driver behind SEB’s relative underperformance is its elevated cost base, which has increased significantly since early 2022.

All major expense categories are up by more than 30%, and since Q3 2024 the bank has posted negative operating leverage—costs rising faster than income, pressuring profits.

SEB’s expenses in Q1/2022 and Q3/2025 (SEKm) and the relative change (%). Source: SEB’s interim reports and factbooks.

To address this, SEB has taken uncharacteristically short-term actions for a bank known for its long horizon and strategic patience. The most striking move is an external recruitment freeze, signaling management’s determination to regain cost control.

Looking Ahead

SEB remains one of the strongest franchises in the region, but its cost dynamics need to improve for the bank to get “back on top” of the peer group. If they can rein in expenses while maintaining income momentum, the gap could close quickly. They do, after all, have the most diversified revenue mix among Nordic banks, with net interest income accounting for only about half of total revenues—making SEB less exposed to falling interest rates than many of its competitors.

However, if SEB fails to get costs under control, it may face a more prolonged period of lagging performance—a scenario unfamiliar to them.